Glossary

Logout

©Copyright Arcturus 2022, All Rights Reserved.

7

Terms & Conditions

|

|

|

|

Security & Privacy

Contact

VOC & KANO ANALYSIS

|Introduction

One of the realities of Product and Service marketing is that Customers are not the same. The total market

being addressed will comprise customers in different personal or business situations who may:

• THINK differently

• BUY in different ways or for different reasons

• And USE the product/service for different purposes.

Furthermore, a typical product may have multiple Customers (Stakeholders that require satisfying) that use or are associated with the Product. This has implications at the strategic level – in the need for a full understanding of segmentation opportunities available. It also has a practical dimension at the tactical level – in terms of how we can successfully execute a particular sales/marketing programme.

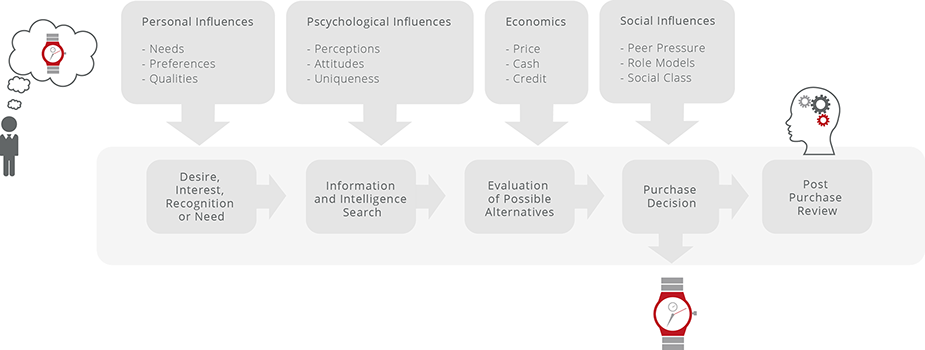

First, we need to be aware that the way we think about different product/services – or about specific brands – will be influenced both by ourselves, as ‘receivers’, and by the messages which are transmitted to us, by suppliers and a wide range of other sources.

Each of us is affected by basic ‘traits’ in personality and by the values and attitudes we develop through life. These all strongly colour our perceptions of the messages we receive. In a business setting, these may be constrained by organisational requirements, but it is still people making decisions – not organisations.

We are more inclined to notice – and give credibility to – messages that are basically in line with what we already believe, think important or do. If a message challenges any of these it may be rejected, even though it is factually correct, or makes a strong claim to be important. This is a process known as ‘selective perception’.

In an organisation, individuals will each apply their own perception and priorities to any decision? The customer ‘realities’ you have to deal with may therefore sometimes be fragmented or even conflicting. They will almost certainly be different.

In organisational purchases, there may be a number of interested parties. Commonly, these include:

The SPECIFIER

The BUYER

The USER

The INFORMED EXPERT

The FINAL AUTHORITY

Together, these form the ‘Decision Making UNIT’ (DMU) for the purchase.

All will have their own ‘realities’ against which they judge the purchase, and the marketing process will not be successful unless they feel their needs are being met (or they are persuaded by other parts of the DMU or outside pressures that the decision overrides their own sectional interest).

Considerable thought needs to be given as to how this process may take place, specifically:

What are the relevant benefits for the different members of the DMU or the total buying/usage situation?

Which is the best point to start off the persuasive process: who is likely to be the ‘gatekeeper’ who we need to interest and persuade first, before we can get any further?

What are the stages we are likely to have to go through in the total process of getting the product/service adopted and fully used?

A further key consideration is an understanding of what is likely to motivate people to buy or to change in some way: what are the motivating factors?

The meaning of the customer requirements needs to be worked out in order to gain a collective understanding. Customer requirements can be separated into two or three levels. More detail is not necessary, because it would make the list too complex to use easily. For this step, Pre‐requisite Market Information. It is vital to the success of the project that the all members of the QFD team understand the product / service target market. It is therefore the responsibility of the Product Manager to prepare a suitable brief to include the proposed target market, together with primary and ring fenced parameters (Target Costs, Product Positioning, Product Price etc.).

|VOCT

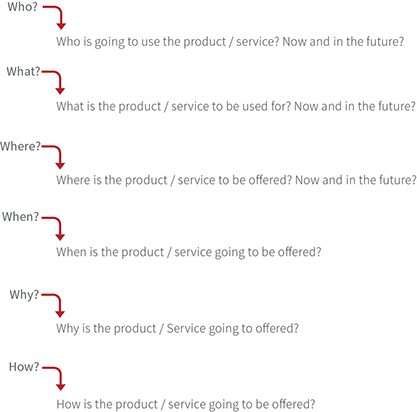

To further understand the user / customer requirements we use a process called ‘VOCT’ analysis.

|Kano Model

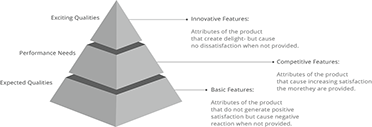

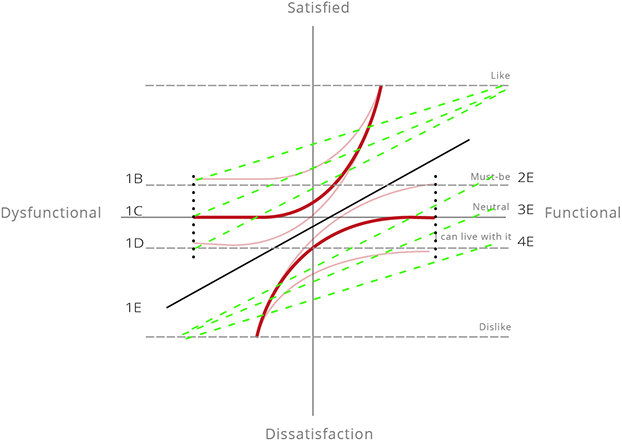

The Kano Model of product development and customer satisfaction was published in 1984 by Dr Noriaki Kano, professor of quality management at the Tokyo University of Science.

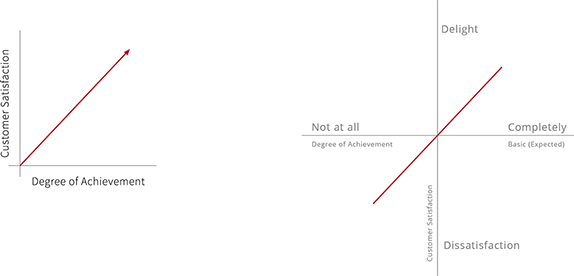

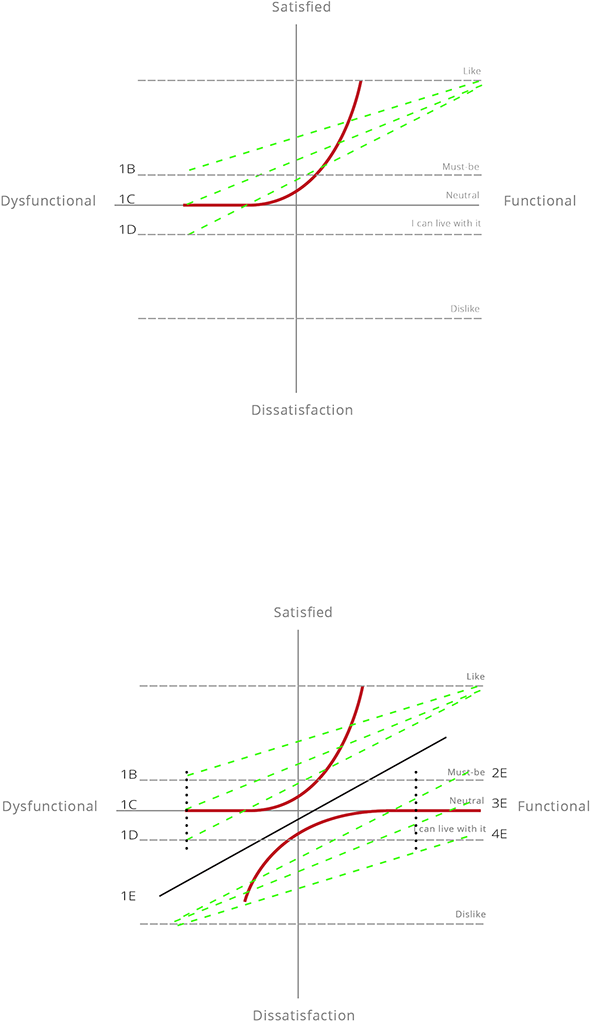

The model encourages you to think about how your products relate to your customers' needs, while moving from a "more is always better" approach to product development to a "less is more" approach.

The Kano model (...in its academic form) encourages you to think about how your products relate to your customers' needs (and associated benefits), while moving from a "more is always better" approach to product development to a "less is more" approach. However despite the visual simplicity of the Kano model, in practice it can sometimes be misunderstood because of the levels of ambiguity and the inability to add facts to the argument and / or hypothesis. This is where this new interactive model (Features and Benefit Analysis) provides a valid solution...

Constantly introducing new features to a product can be expensive and may just add to its complexity without boosting customer satisfaction. On the other hand, adding one particularly attractive feature could delight customers and increase sales without costing significantly more.

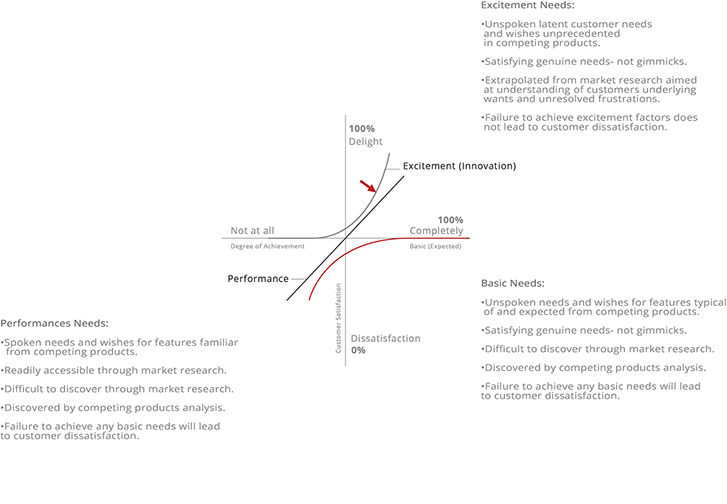

Using Paired analysis, we determine the 3 qualities of your product/service. By using sliders to reveal each hypothesis, results are presented, indicating the following quality levels:

- Basic Qualities

- Performance Qualities

- Innovative Qualities

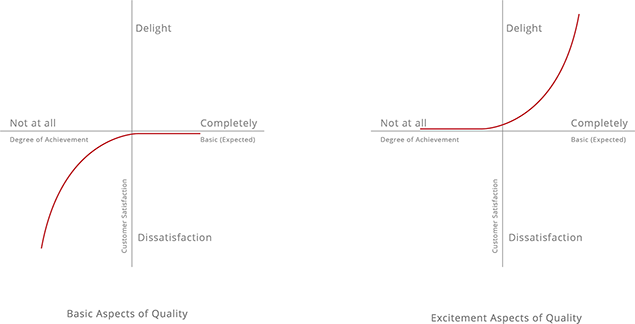

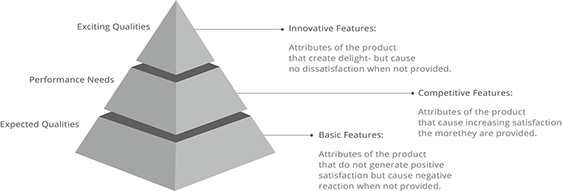

The model assigns three types of attribute (or property) to products and services:

1. Threshold Attributes (Basics). These are the basic features that customers expect a product or service to have.

2. Performance Attributes (Satisfiers). These elements are not absolutely necessary, but they increase a customer's enjoyment of the product or service.

3. Excitement Attributes (Delighters). These are the surprise elements that can really boost your product's competitive edge. They are the features that customers don't even know they want, but are delighted with when they find them.

|Know Expressed, Implicit and Attraction Requirements

Focus on the Customer

Who is the customer? If we do not know the customer, we do not know his wishes and requirements. This question often gives rise to heated discussions, due to the fact that there are various perspectives from which this question can be answered. It is of vital importance to the process that a consensus is reached within the team about the kind of customer to focus on. If we cannot agree on the target customer, this discussion will be repeated regularly, thus causing team member confusion and reduced team productivity. We need to have a clear customer profile. A good description includes the end‐users, but could also include a profile of the persons who buy the product and perhaps the dealer who influences the potential buyer in his/her purchase decision. Even a Consumers’ Association could have a place in this description, because they provide potential buyers with overviews of the results of product evaluations.

Suppose that we know our customer and ask him about his requirements for the product. The wishes and requirements he will then give us, we call expressed requirements. The more of these requirements he will find fulfilled in our new product, the more he will feel inclined to buy it. Apart

from these expressed requirements, we must also consider the customer’s implicit requirements. These are the requirements which are not expressed by the customer, but which he assumes to be present. Implicit requirements refer to the dis-satisfiers in products (i.e. safety, risk and reliability). ...we must generate these requirements ourselves. Finally, the attraction requirements are neither expressed nor expected by the customer, but when he notices them, he will be surprised and excited. Attraction requirements refer to the satisfiers in a product. These requirements are of the utmost importance in attracting the attention of customers and getting the product sold.

|Kano Model

The above can also be represented as follows;

|Paired Questions

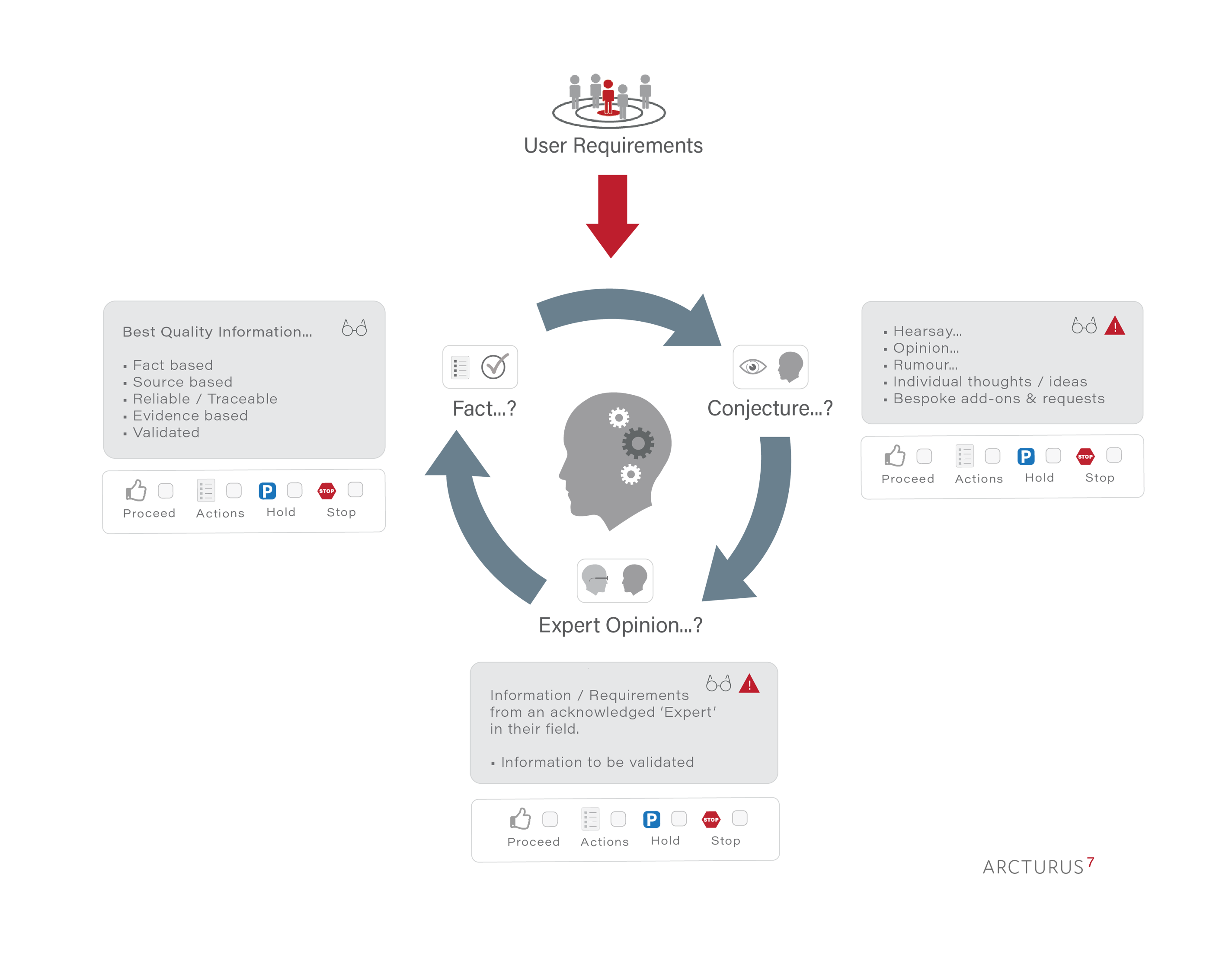

|Information Intelligence - Quality of Information / Validation Algorithm

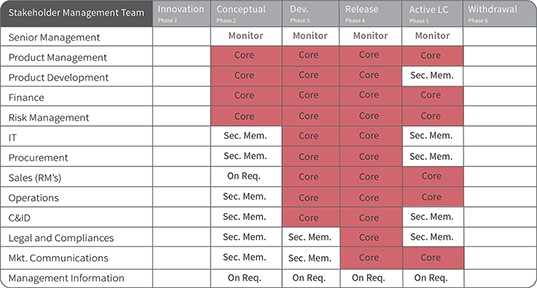

|Who Should Attend...

Key / Definition:

Monitor: Oversees the overall process, required to provide top level strategic objectives as required,

performs a management role.

Core: Defines the ‘Core’ team headed (chaired) by the Product Manager required to attend the workshop in alignment with the ‘Product Phase’. Membership is mandatory.

Sec. Mem: Secondary Membership defines an ‘on‐standby’ membership requirement and will depend upon the subject area, phase alignment and the project status. Membership is managed by the Product Manager.

On Req: On Request membership defines a membership that is managed by the Product Manager.

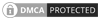

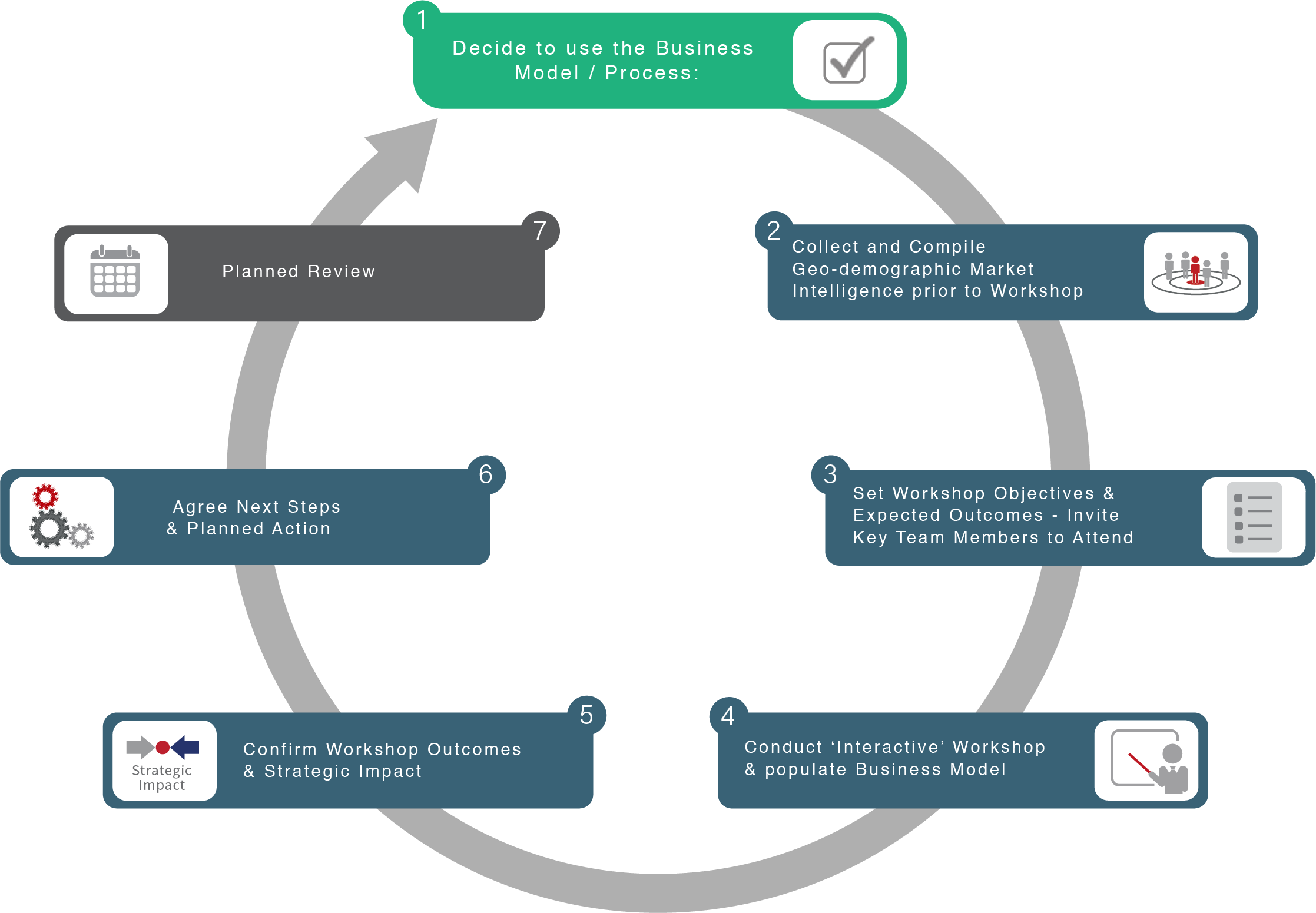

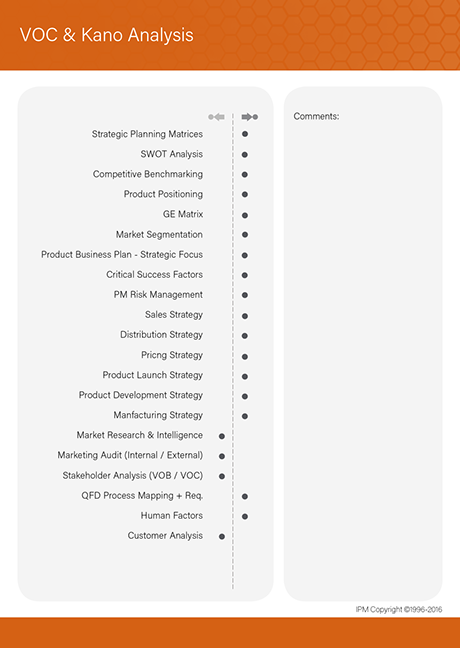

|Related Procedures

The following interrelationship maps indicate; suggested content from other models/processes which may have influence or an effect on the analysis of the title process. The left-hand column indicates information or impact from the named process and the left-hand column indicates on completion of the process/analysis it may have an influence or effect on the listed processes.

Note: A complete set (professional quality) of PMM interrelationship cards are available to purchase - please contact us for further details.

|Strategic Business Models, Workshop Tools & Professional Resources

The IPM practitioner series, is a definitive and integrated training programme for management professionals operating in the Product Management arena. So whether you’re the Managing Director, Product Director, Product Manager or a member of the Multidisciplinary Team we are confident that you will find this particular training series to be one of the best available and an invaluable asset to both you and your company.

PMM - Professional Support

Interactive Business Models

More