STRATEGIC PRICING

|Introduction

Pricing Objectives

These are the most common objectives in pricing. They need to be considered together, because all pricing decisions involve certain compromises.

To achieve a target level of profitability: ‐ This is usually the most common objective.

It may be expressed as:

1. £ total profit

2. % return on sales

3. % return on capital employed (RoCE)

It is unlikely to remain fixed through the life of a product, and may vary according to the competitive situation.

To support a planned market position: ‐ This recognises the compromise between profitability and market share.

For example, the objective may be...

- To achieve volume and cost leadership. Or...

- To be the No. 1 or No. 2 product in all sectors through a differentiated strategy of quality or

value leadership. Or...

3. To be a small but highly profitable ‘niche operator’ in a targeted market.

To pre‐empt, meet or follow competition:‐ Related to the role you want to play in the market.

Objective could be:

- Market leader

- Market ‘follower’

- An ‘equal player’

To differentiate product or Company image

Price is one of the strongest ‘signals’ to the market. It can be used to project an image of either “value for money” or “quality and exclusiveness”.

Customer Perceptions

Customers equate price with quality, to make a judgement on ‘value for money’.

For certain basic items (e.g. bread, petrol) the acceptable range of prices is very narrow. For items where quality or images are important (e.g. perfume, jewellery), the acceptable range of prices can be wide.

Another aspect of the ‘psychology of pricing’ is that in certain cases price can be too low for the customer to believe that the quality is good enough.

Competitive structure of the industry

In markets where a lot of competitors are offering similar products, there is little opportunity to be flexible in pricing.

Where one company, or a few companies, dominate the market and customers have little choice in whom to buy from, the supplier has much more control over the price he charges.

In most markets, one company will be seen as the ‘price leader’ and others will have to decide whether to price at the same level (‘parity’), slightly higher (‘premium’), or slightly lower (‘discount’).

Price sensitivity of industry demand

The overall level of price in the industry is determined by the extent to which demand will increase if prices are reduced, and the extent to which demand will decrease if prices are increased.

This will be influenced by:

- The importance of the product to the buyer.

- Whether the demand is direct, or derived from association with another product.

- Whether the market is saturated, or there is a potential for greater volume.

- The relative affluence of buyers.

Company cost structure

Ideally, price should be sufficient to cover the direct costs of producing the product, and make an appropriate contribution to general overheads, and also make an acceptable contribution to company profits.

Using a “cost plus” approach to pricing can lead to problems and missed opportunities:

- It may not result in a price, which is acceptable to customers, or comparable with competitors.

- It may conceal potential economies, because it focuses on present volume and costs.

- It can lead to complacency on cost levels, because the cost is passed on to the buyer, and result in lost profit opportunities.

Company goals and position

Companies with an established position in a developed market have little to gain from aggressive pricing, because retaliation can wipe out any gains and everyone will lose.

Weaker companies or newer entrants with large resources may attempt to use price in this way to ‘buy a position’ in the market.

Company goals can also affect price policy. They involve a conflict between short and long term considerations. One common conflict is between short‐term profits versus market share gains (which may enhance profit in the long term).

In order to achieve the desired objective a suitable strategy has to be followed.

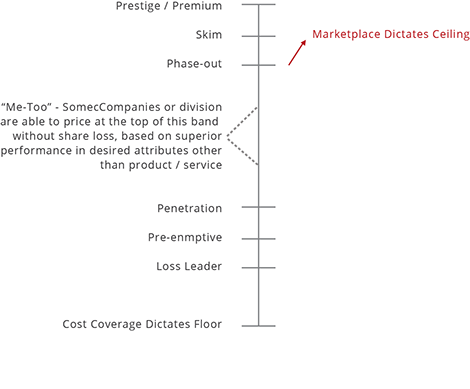

Prestige Pricing

The ultimate in terms of ‘Pricing’ strategy, where there is no longer any direct link between the price and the physical attributes or benefits offered.

Examples could come from;

- Science & Chemistry

- Bespoke Engineering

- Consultants / Specialists

Premium Price

For high quality products... It reflects a differentiated product where the margin is the main aim rather than maximum volume.

- Hi Tech Products

- Cosmetics

- Fashion Items

Skimming

Pricing at an inordinately high level to hit the upmarket buyers...

Circumstances suggesting this pricing strategy:

- Unique product or service (brand new or drastically improved)

- Little danger of short‐term competitive entry due to patent control, high R&D costs, high promotion costs, raw material control, etc.

- Product uniqueness creates relatively inelastic demand

- Need to limit demand until production is geared up

Sliding Down Pricing

Moving prices down to tap successive layers of demand...

Circumstances suggesting this pricing strategy:

- Often starts with skim pricing

- Product / Service will be valuable to progressively larger groups of users at lower prices (Price inelasticity).

- Company dedicated to ‘learning curve’ pricing

- Progressively lower prices will discourage competitive entries

- Economies of scale (Manufacturing and Marketing) will occur as volume of output increases

Penetration Pricing

Setting prices attractively low, but not so low that it causes concern in terms of perceived quality.

The aim is to maximise market share quickly and gain benefits of scale. With lower costs through economies of scale, profits can be made at price levels which competitors cannot operate at.

Circumstances suggesting this pricing strategy:

- Desire or need to establish a foothold in a particular market

- Existing competitors are not expected to react to your prices

- Product / Service is a ‘me‐too’ entry

- Belief in ‘share dictates profits’ concept

- Demand is price elastic.

Marginal Pricing

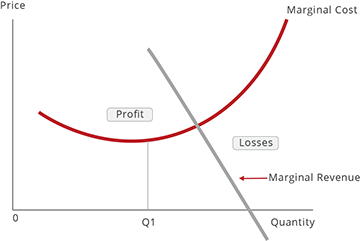

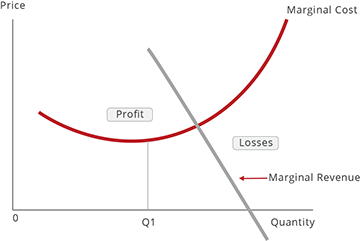

Marginal cost is the increase in total cost as a result of producing and selling one more unit of a product.

From zero production up to a volume of Q1 marginal cost decreases; then begins to increase. Q1 represents the point where economies of scale have been exceeded. After this point, marginal costs tend to increase.

Marginal revenue is the additional amount received as a result of selling one more unit of a product. Note: Marginal revenue decreases as quantity increases.

This is because of the supply and demand phenomenon, whereby people will buy greater quantities of a product at lower prices.

In theory, marginal pricing produces the best price-volume relationship to yield maximum profits. Unfortunately, in the “real world”, this tool is somewhat impotent even in the simplest case because of several limitations...

- Marginal costs and marginal revenues are difficult to identify, except in a broad range. The range of intersections yields only a range of prices, not the exact one.

- Cost schedules are difficult to prepare; revenue schedules are almost impossible to prepare with sufficient accuracy for price planning.

- Product Managers don’t think in terms of a single unit; they think in terms of volume.

- Errs in assumption that the only right price point between cost and value is the one that

maximises short‐run profit.

Elasticity Pricing

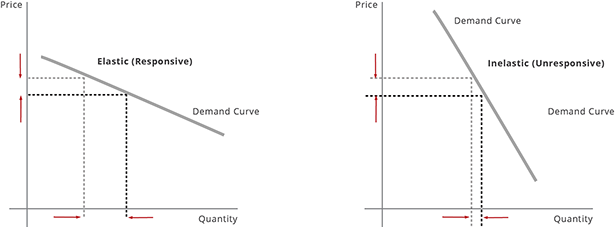

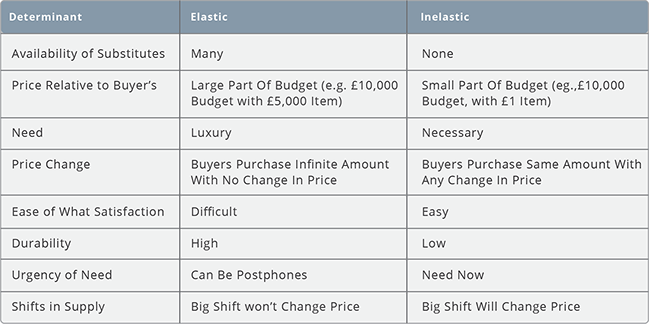

Pricing to take advantage of known or perceived price elasticity.

Circumstances suggesting this pricing strategy:

Down‐side of elasticity

- Under-utilisation of capacity.

- Reductions in unit production / selling costs as volume grows.

- Reasonable assurance that the market will respond to lower prices with higher prices with higher volume of prices.

Upside of elasticity

- Product / Service features that are value oriented.

- No apparent easily ‘substitutable’ product / service

- Product makes up relatively small portion of total ultimate production cost.

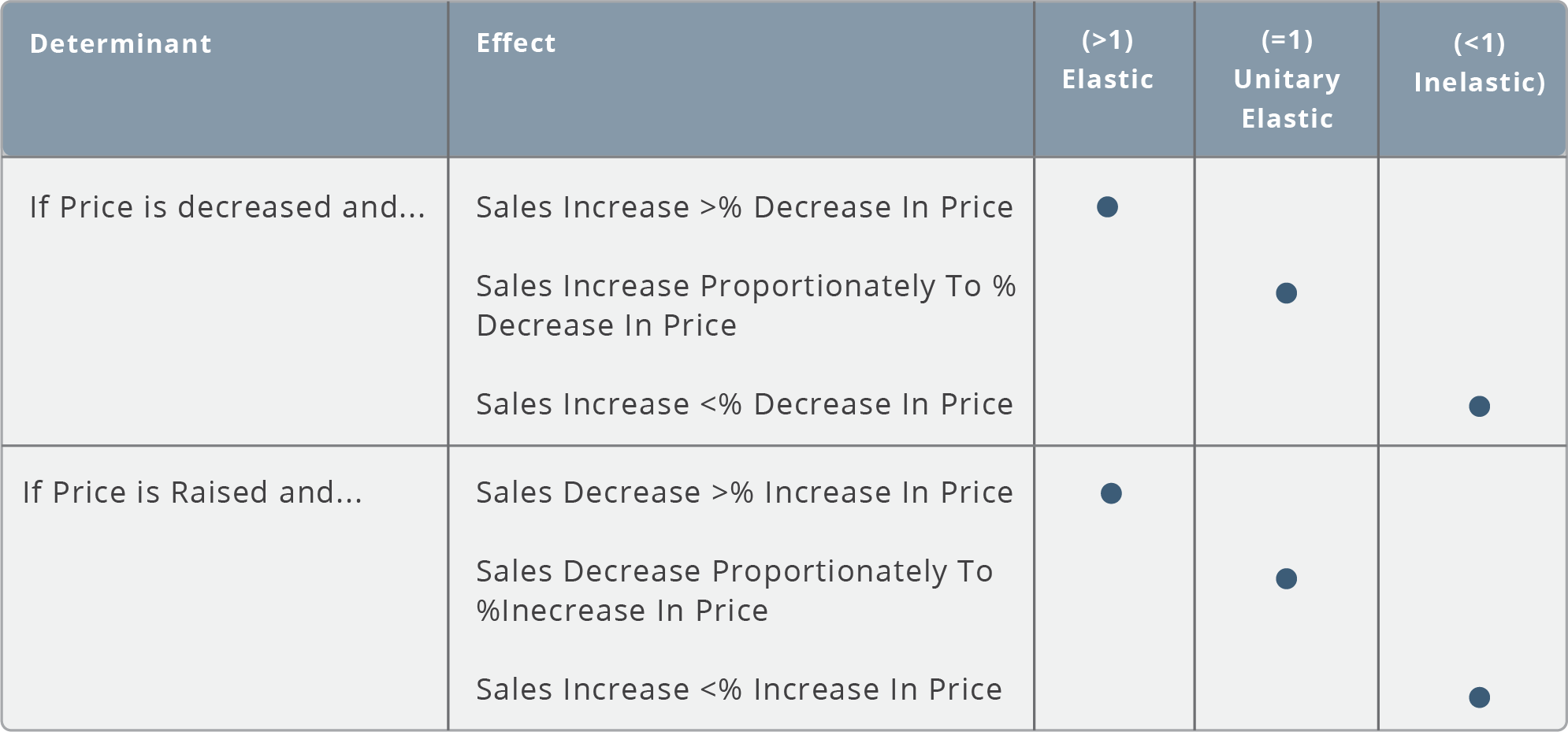

Determinants of Demand

Effect of Price Change on Sales

Psychological Pricing

Pricing at a level that sounds lower than it is ... like £99.95.

Circumstances suggesting this pricing strategy:

- More likely to be a consumer product.

- Price desired by seller is close to multiples of 10, 100, 1000, etc.

- Where price is likely to be advertised, displayed or quoted in writing.

- In a market where ‘reverse’ psychological pricing is not prevalent.

- During a special promotion.

Follow Pricing

Pricing in relation to industry price leaders.

Circumstances suggesting this pricing strategy:

- A small or medium‐sized company in an 80/20 market.

- Industry has traditional price leaders.

- ‘Flexible’ or attack pricing would probably elicit price reaction from price leaders.

- Following price moves of industry price leaders has resulted in acceptable ‘share’ and profit position.

- Products and attending services have no positive distinguishing features.

Segment Pricing

Pricing essentially the same products ‘differently’ to various market.

Circumstances suggesting this pricing strategy:

- Product / Service has usefulness to several or many different markets.

- Product can be easily ‘fine‐tuned’ to various segments varying needs.

- Consuming segments are non‐competitive.

Cost‐Plus Pricing

Building price up from cost floor generally on a percentage basis.

Circumstances suggesting this pricing strategy:

- Governmental market / tenders

- Unpredictable’ total cost

- Project that moves in phases

- New product testing phase of development

Flexible Pricing

Pricing to meet changing competitive / marketplace conditions.

Circumstances suggesting this pricing strategy:

- Competitive challenge from imports

- Pricing intentionally low to break predictable pattern

- Competitors attacking a market (in which you have a strong market position) with penetration pricing.

Pre‐emptive Pricing

Pricing to discourage competitive market entry.

Circumstances suggesting this pricing strategy:

- Strong...sometimes monopolistic...position in medium to small market that you want competitors to see as unattractive.

- You are serving the market well enough that customers do not encourage competitive entry.

Phase‐out Pricing

Pricing “high” to remove a product from the line.

Circumstances suggesting this pricing strategy:

- Product has entered down part of life cycle ... but is still used by a few customers.

- Customers can design “around” the product in a relatively short time period.

- Flat withdrawal of the product from the line would leave customers high and dry ... and mad!

- To help “prune” a product line that has proliferated over the years.

Loss Leader Pricing

Pricing an item/items “low” to attract buyers for other products.

Circumstances suggesting this pricing strategy:

- attractive item that will draw attention and customer flow.

- Adjacent or complementary products available that can be sold in “combination” with leader at normal or higher prices.

- A business where customer flow generally results in impulse sales.

Pricing Strategies Overview

Prestige : No longer any direct link between the price and the physical attributes or benefits offered.

Premium : It reflects a differentiated product where quality of profit margin is the main aim rather than maximum volume.

Skim: Pricing at inordinately high level to hit the “cream” buyers.

Slide Down: Penetration: Moving prices down to tap successive layers of demand.

Penetration: Pricing below the “prevailing” level to gain market entry ... or to increase market share.

Elasticity: Pricing to take advantage of known or perceived price elasticity or inelasticity.

Psychological: Pricing at a level that “sounds” much lower than it is ... £99.95

Follow: Pricing in relation to industry price leaders.

Segment: Pricing essentially the same products “differently” to various markets.

Cost- Plus: Building price up from cost “floor” ... generally on a percentage basis.

Flexible: Pricing to meet changing competitive/marketplace condition. Pricing to “Discourage” competitive market entry.

Pre-Emptive: Pricing to “Discourage” competitive market entry.

Phase-Out: Pricing “high” to remove a product from the line.

Loss-Leader: Pricing an item(s) “low” to attract buyers for other products.

What is the pricing policy for the product?

Knowledge of the current end user price and predictions of future prices are obviously critical for this plan.

It is important to derive this information for all significant distribution channels. What will your strategy and tactics be on product pricing...

- Pricing Strategy Type

- List Pricing

- Allowances and discount policy

- Multiple product discount policy

- Elasticity of demand analysis

Prestige: No longer any direct link between the price and the physical attributes or benefits offered.

Premium: It reflects a differentiated product where quality of profit margin is the main aim rather than maximum volume.

Skim: Pricing at inordinately high level to hit the “cream” buyers.

Slide Down: Moving prices down to tap successive layers of demand.

Penetration: Pricing below the “prevailing” level to gain market entry ... or to increase market share.

Elasticity: Pricing to take advantage of known or perceived price elasticity or inelasticity. Pricing at a level that “sounds” much lower than it is ... £99.95.

Psychological: Pricing at a level that “sounds” much lower than it is ... £99.95

Follow: Pricing in relation to industry price leaders.

Segment: Pricing essentially the same products “differently” to various markets.

Cost-Plus: Building price up from cost “floor” ... generally on a percentage basis.

Flexible: Pricing to meet changing competitive/marketplace condition.

Pre-Emptive: Pricing to “Discourage” competitive market entry.

Phase-Out: Pricing “high” to remove a product from the line.

Loss-Leader: Pricing an item(s) “low” to attract buyers for other products.

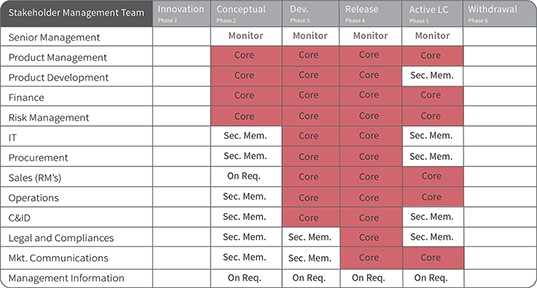

Stakeholder Management Team

The following delegates / members of the Stakeholder Management Team (SMT) should attend the Pricing Strategy workshop.

Key / Definition:‐

Monitor: Oversees the overall process, required to provide top level strategic objectives as required,

performs a management role.

Core: Defines the ‘Core’ team headed (chaired) by the Product Manager required to attend the workshop in alignment with the ‘Product Phase’. Membership is mandatory.

Sec. Mem: Secondary Membership defines an ‘on‐standby’ membership requirement and will depend upon the subject area, phase alignment and the project status. Membership is managed by the Product Manager.

On Req. : On Request membership defines a membership that is managed by the Product Manager.

|Who Should Attend...

|Influences on Pricing

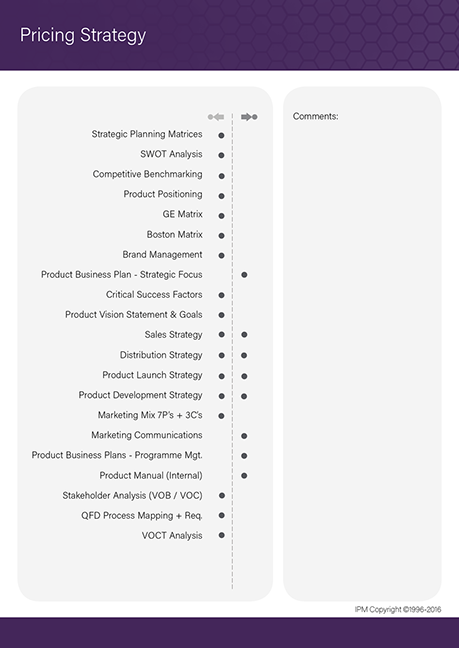

|Pricing Strategy

|Pricing Strategy Type

|Pricing Strategy

Workshop Tasks Algorithm (Generic) ...

Click to expand

|Related Procedures

The following interrelationship maps indicate; suggested content from other models/processes which may have influence or an effect on the analysis of the title process. The left-hand column indicates information or impact from the named process and the left-hand column indicates on completion of the process/analysis it may have an influence or effect on the listed processes.

Note: A complete set (professional quality) of PMM interrelationship cards are available to purchase - please contact us for further details.

|Do's and Don'ts

Do’s

- Work pragmatically to arrive at a pricing strategy

- Have contingency plans.

- Use management ratios as your early warning system

- Realistically plan for pricing changes.

Don’t’s

- Don’t guess

- Do not overestimate the size of the market.

- Don’t ignore demand and depend solely on cost to determine price.

- Don’t rely solely on some mechanical formula to determine the “right” price.

- Don’t ignore ‘fixed’ costs (advertising and promotion expenditures, distribution costs,

development costs, sales costs) when setting prices.

- Don’t force every product’s price to yield a predetermined, satisfactory profit in the short-term.

- Don’t ignore competitive pricing actions.

- Don’t assume that a price cut automatically enables you to win customers away from rivals.

It may simply force rivals to match your cuts.

- Don’t lower price just because of declining sales.

- Don’t assume that a price increase will automatically cause loss of your customers to rivals.

It may provide a long awaited opportunity for them to match your increase.

- Don’t change prices upward or downward, and consider the job done. Close monitoring of the effect on overall sales trends within key accounts is essential.

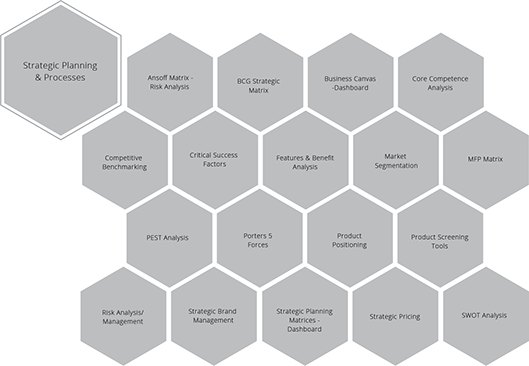

|Strategic Business Models, Workshop Tools & Professional Resources

PMM - Professional Support

Glossary

Logout

©Copyright Arcturus 2022, All Rights Reserved.

7

Terms & Conditions

|

|

|

|

Security & Privacy

Contact