Glossary

Logout

©Copyright Arcturus 2022, All Rights Reserved.

7

Terms & Conditions

|

|

|

|

Security & Privacy

Contact

MARKET RESEARCH & INTELLIGENCE

|Introduction

Market research information is a key component in the construction of the product business plan.

'The marketing environment is constantly changing and evolving in many different ways. Without knowledge of these changes it is impossible to develop a successful business strategy'

There are known knowns. These are things we know that we know. There are known unknowns. That is to say, there are things that we know we don't know. But there are also unknown unknowns. There are things we don't know we don't know.

Donald Rumsfeld

Market data and intelligence is the starting point for all new projects. Thereafter Product Managers engaged in the planning and the of product development continuum and evolution must use and act appropriately upon market research and intelligence data. By analysing the structure and dynamics of the market(s) in which is competing (or wishes to compete), Product Managers can gain insights into the performance of individual products relative to the competition, evaluate future prospects and develop marketing strategies which are responsive to the challenges presented by specific segments of the overall market:

Among the most significant questions facing product managers in this respect are:

1. How large is the market for the product in question? Is it growing or shrinking? and Why?

2. What are the major forces influencing demand for this product?

3. Can the market usefully be segmented, and, if so, along what dimensions?

4. At what stage in the product life cycle is this market? Are we dealing with a new product category or a mature and well‐established one?

5. Is demand consistent over time and does it fluctuate sharply in response to temporal or cyclical factors?

6. Who are the competitors serving this market and what are their market shares? How and why have these shares been changing over time?

7. What are the demographic characteristics of customers and potential customers in this market?

8. Are there any major customer needs or wants which are not currently being satisfied?

From a business / strategic planning point of view it is important that data consistency is maintained and as such Product Managers should only use calibrated data from a single source. You should in all instances contact marketing for core market intelligence information when compiling business plans.

The above highlights the importance of Product Managers to understand the structure and dynamics of markets in which they market their products. While qualitative evaluations often provide valuable insights, it is generally also necessary to express market characteristics in quantitative terms for purposes of planning and evaluation.

An understanding of the competitive structure of the market, characteristics of the distribution channels serving it, the needs and buying behaviour of existing and potential consumers are also important adjuncts to market analysis.

|Timeframe

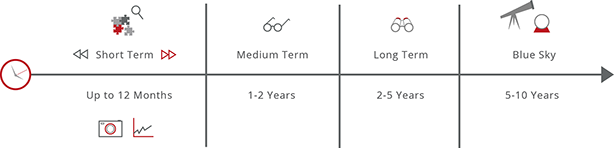

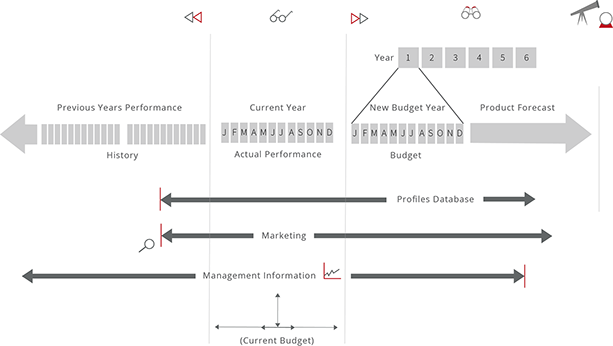

The following diagram represents various timeframes associated with market research and intelligence. It is very important that the overall market is well understood by the Product Manager.

The following diagram indicates the ‘timeframe’ for the ‘profiles’ database and associated management functions / roles; Marketing and Management Information...

|Primary Demand - Available Market

The term “primary demand” (total available market) is commonly used to refer to the total industry

demand for a given product category.

Sometimes, it may be difficult to determine exactly how large the market is. The problem is often one of definition. An unduly narrow definition of the market may result in the overlooking of potentially profitable marketing opportunities or ignoring competitive threats from products that perform a similar or related function for the consumer. On the other hand, defining the market too broadly may fail to yield a useful basis for evaluating a specific product’s performance and potential, or for planning future strategy. The scope and dimension of ‘primary demand’ will ultimately effect how the overall market is benchmarked and then translated into the associated / aligned ‘market share’. It is not uncommon to see a variety of statistics to describe the ‘available’ market (volume / value) so be careful with the definition and interpretation as they can be easily mixed by mistake. For clarification, it should be noted that primary demand (total available market) does not represent the size of the installed base of the (target) market; it represents churn / new opportunities.

Assessing the size of the market may range from a relatively simple task that can be expected to yield quite reliable information to a complex procedure, yielding only approximate “guesstimates”. Many industry statistics are readily available through government statistical publications or are published through trade associations. In other instances, estimates can be purchased from professional research companies that survey sales through a representative sample of potential customers, or through specially commissioned market studies. Internally generated estimates may be developed from such sources as trade contacts or sales force reports.

Since market estimates may vary widely in accuracy, it is important to determine the source of the estimate and how the figures were derived in order to evaluate their credibility.

|Determinants of Demand

Having obtained some quantitative notion of the size of primary demand, it is desirable to examine the broad trend of demand patterns over time and forecasts for the future. These trends should be reviewed in the light of qualitative or quantitative information, with a view to evaluating the forces that serve to determine demand levels for a particular product category.

Among these determinants may be the level of disposable personal incomes, trends in life styles technological advances, economic expectations, etc. In many instances, the demand for one product is a derivative of the demand for a related one. As an example, the demand for jet aircraft determines the demand for jet engines; car audio sales are in large measure a function of new car production levels; and so forth.

|Market Segmentation

Market segmentation is defined as the process of dividing the consumer market into meaningful buyer groups and then creating specific marketing programs for one or more of the resulting segments with a view to achieving financial and other corporate objectives. It represents a middle way between a strategy of market aggregation, in which all consumers are treated similarly, and one of total market desegregation, in which each consumer is treated uniquely.

The concept of segmentation is based on the propositions that (1) consumers are different; (2) differences in consumers are related to differences in market behaviour; and (3) segments of consumers can be isolated within the overall market. The benefits that may result from a segmentation approach include:

- A more precise definition of the market in terms of the needs of specific groups, why they behave as they do, and possible ways of influencing behaviour;

- Improved ability to identify competitive strengths and weaknesses, and opportunities for winning specific segments from the competition;

- More efficient allocation of limited resources to develop programs which can best satisfy the needs of target segments;

- Clarification of objectives and definition of performance standards.

The basic problem is to select segmentation variables that are likely to prove useful in a specific operational context. It can be argued that each of the following three criteria must be satisfied if meaningful market segments are to be developed:

- It must be possible to obtain information on the specific characteristics of interest.

- Management must be able to identify chosen segments within the overall market and efficiently focus marketing efforts on these segments.

- The segments must be large enough (and/or sufficiently important to the organisation) to

- merit the time and cost of separate attention.

The overall market for any given product can generally be segmented along several different dimensions. Thus, one can segment the market:

- Geographically (according to where consumers live or where they purchase and use the product);

- By demographic characteristics of consumers (sex, age, income levels, stage in the family life‐cycle, education level, occupation, etc.);

- By consumption volume or size of unit purchase;

- By the different uses to which the product is put;

- According to what are termed psychographics (variations in consumers’ needs resulting from lifestyle or personality characteristics);

- By product attributes (such as size, price range, portability, technical features, etc).

It is often useful to segment a market along two or more dimensions at once, but concurrent use of multiple methods of segmentation may lead to an unmanageable and meaningless number of market segments. The same consumer may fall into different segments in different marketing situations. For one product category, the most important variable may be the consumer’s age, while for others, it may be income level, the purpose for which he or she buys the product, or the type of retail outlet selected etc.

|Market Segmentation

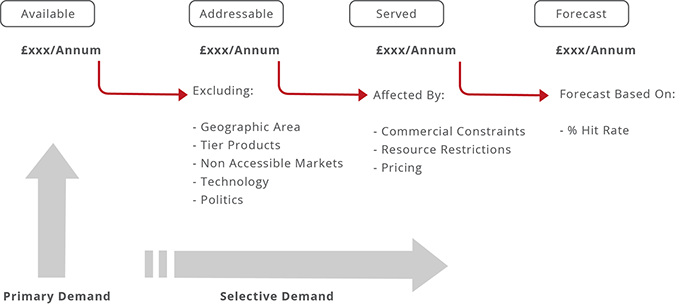

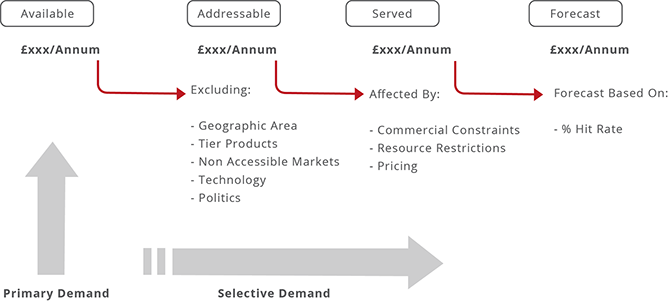

Selective demand by definition is a portion of the total available market being strategically addressed, served and forecast. Considered in relation to primary demand, it indicates the market share that a company may possess or potentially hopes to achieve. If we are competing in a limited number of market segments, it may be more useful to consider market share relative to these segments alone, rather than simply as a percentage of the overall market.

In attempting to increase sales volume, companies are sometimes faced with the choice of seeking to expand either primary demand or selective demand. As the total market grows, so should that of the product sales, even if your market share remains constant. A strategy of stimulating selective demand may be more appropriate when a company has a relatively small share of a particular market. Selective demand stimulation involves promotion of brand awareness and preference, with a view to gaining market share from competing brands.

The choice of strategy (and sometimes a hybrid one may be appropriate) should be derived from careful analysis of market structure and trends, as well as evaluation of competitive strategies.

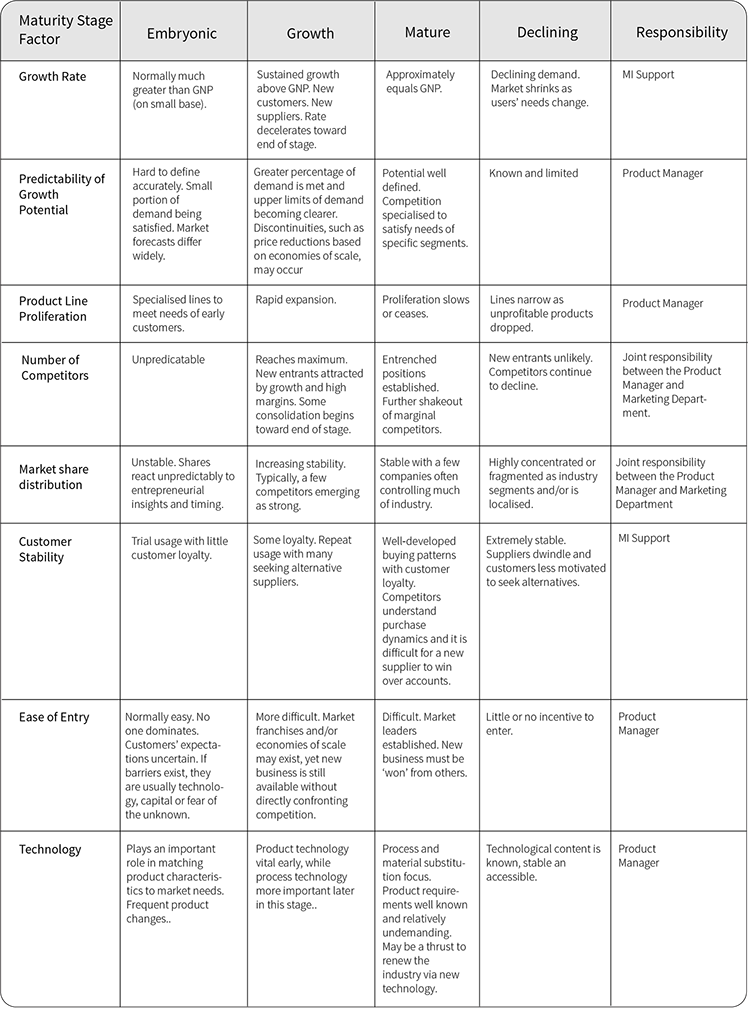

|Stage in Product Life

One factor that may help to determine the potential for stimulating primary demand is the newness or maturity of the product category in question. Most products (other than fashion or fad items) go through a life cycle, beginning with an introductory phase and moving over time through growth, maturity and decline phases to finish with withdrawal from the marketplace. Some, of course, die young.

As sales expand, costs and prices typically fall and thus stimulate further growth in sales, accompanied perhaps by added product features and new uses. In time, however, the product may be displaced by new substitutes or the environment may change and eliminate consumers’ need for this product category. This is also true for products with a ‘service’ bias where forecasting has a direct relationship to the level of resource (fixed costs) that is required across the PLC.

|Temporal or Cyclical Variations in Demand

Market demand may not always be consistent over time. The demand for many products is highly seasonal, reflecting climatic variations, cultural or religious customs, or established societal practices such as beginning the school year in the autumn. For this reason, it is important to make seasonal adjustments for comparative purposes and for determining the overall trend of the market.

In other instances, there may be established cyclical variations in demand, which unless identified, can obscure any secular trend in sales.

These fluctuations may be very significant for planning future strategy. In addition to their implications for production and logistics scheduling, such fluctuations may influence the timing of promotional and selling activities.

|Market Maturity 'LifeCycle'

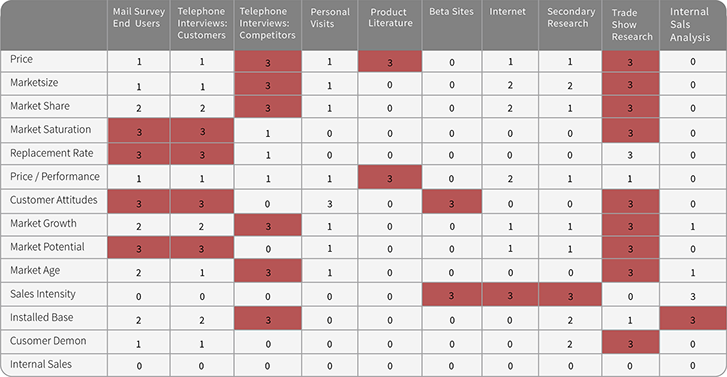

The table below represents the ‘maturity’ of the target market against various commercial attributes that can be quantified and measured.

|Method

Identify Problem or Opportunity

In any specific study, the starting point has to be to gain a clear understanding of the problem / opportunity / decision involved and its marketing context.

Ask yourself:

- What exactly is the marketing issue you are addressing?

- What is it you need to know to help resolve the issue, and from whom?

Then ask:

- What are you going to do with the information when you have got it? Do any real choices exist?

- How important is the issue? What level of research investment does this justify?

- What timescale is available? Does this allow enough time for a full research programme?

- This is a vital first step: to identify and state the marketing issues very clearly, in a briefing document which also covers the level of budget and timescale available.

|Start with 'Desk Research'

Before going into expensive forms of external research, thoroughly check all sources of currently available information – inside (Profiles Database) and outside the company (Contact Marketing). It’s usually surprising how much useful information is available from published sources, or can be derived from internal data with a little thought or analysis.

Note: Validate any market information with ‘Marketing’ before using.

Please collect appropriate market research and intelligence about your target market/product and copy to the Marketing Department for collation.

|Exploratory / Qualitative Research

Sometimes it’s more valuable to have a greater depth of information from a few key individuals than a little from a large number. This particularly applies when you want to explore how people really think or perceive something, or where you want to fully explore their ideas in depth.

This can be handled by 2 main techniques: individual in‐depth interviews or group discussions (sometimes called ‘focus groups’). Both tend to use a question list rather than a fixed questionnaire and both are best handled by a professional.

In other situations, exploratory research – properly handled – can be conducted by the Product Manager themselves. This may cover discussions with ‘informed opinion’ or colleagues in parallel markets, feedback from distributors, your own customer‐contact staff, or simply by observation.

Sometimes enough information is available at this stage for the issues to have been clarified and a decision to be taken. In other cases, what emerges is that customers think or act in a very different way than you thought, and the research brief needs rethinking.

A third outcome may be that some fairly clear indications are emerging, but you would like the confidence of a larger sample before taking the final decision – you need to go into quantitative research with a full survey.

Note: It important to validate any market information with ‘Marketing’ before using any data. Data if appropriate should be used within the Profiles database for others to share.

Please work in conjunction with the Marketing Department to initially scope and action exploratory / qualitative research.

|Quantitative Research

Check that the original brief still holds good, then take your thinking a little further. For example, is there a particular form in which the information would be more useful? Do some areas of the enquiry need more precision in their answers than others, and does this have implications for the types of questions that would need to be used? Are you still happy with the way you have defined your target group for sampling purposes?

All these details can be sorted out for you by the research agency or in‐house specialist when the Research Proposal is put together and the form of the questionnaire drafted out.

If you are happy to go ahead, then think about running a Pilot Survey with, say, 10% of your sample first. This will give you a final check that the questionnaire is understood and is likely to give you the information you need.

In terms of the main survey, you basically have three choices in how the information is to be collected:

- By Post, e‐mail, web site forms; where the questionnaire is available / mailed out with a covering letter. This is relatively quick and cheap, but requires the careful development of questions (closed / open etc.). In the final analysis, you have to be satisfied with the response you will get and the quality of information it will yield.

- By Telephone. Again, quick and cheap, but it has to be kept fairly short and simple. There may also be limits on when certain people are contactable on the phone

- By Personal Contact, where an interviewer goes through the questionnaire face‐to‐face. Personal interviewing usually allows the fullest and most reliable research information, but can take more time and involve more expense. Unless trained staff is used, there can also be some question marks over its complete reliability.

Finally, the information from the questionnaires needs checking and analysing to allow the final report to be drawn up. Where an outside agency has been involved, it is usually better to ask them to make a verbal presentation, so that the findings and conclusions can be fully discussed with all parties concerned.

Depending upon where your product is placed within its product life will depend upon the type and extent of the information required.

Note: Product Managers should contact; Marketing for generic quantitative and qualitative market information regarding intended markets.

The type of market information following is an introduction to the other aspects / types of market research which could be provided for your project.

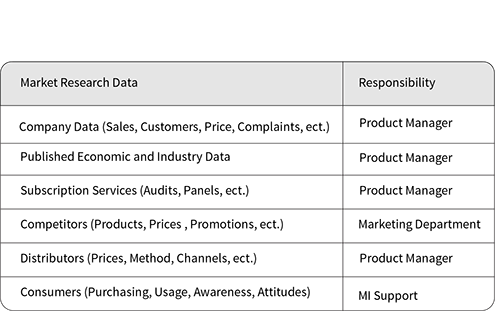

|Types of Market Research

There are fundamentally two types of market intelligence streams:

1. Providing Continuous Information to help the company plan strategies, programs, activities.

2. Providing information for Specific Guidance on a problem, opportunity or marketing change

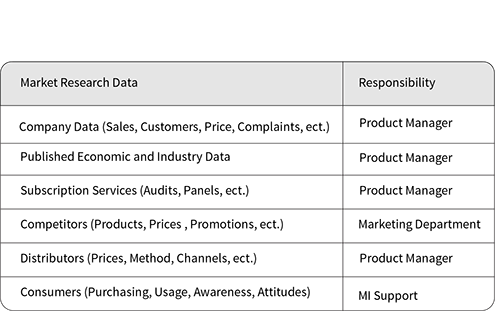

|Continuous Monitoring of the Marketing Environment

Purpose:

• Early warning on problems

• Spotting marketing opportunities

• Data for forecasting and budgeting

• Corporate planning

Projects:

• Company data (sales, customers, prices, complaints, etc.)

• Published economic and industry data

• Subscription services (audits, panels, etc.)

• Competitors (products, prices, promotions, etc.)

• Distributors (prices, method, channels, etc.)

• Consumers (purchasing, usage, awareness, attitudes)

Uses:

• Company information system

• Regular ‘update’ reports

• Regular presentation meetings

• Occasional ‘emergency’ warnings

• Databank/files/library for consultation

• Market reviews for briefings and budgeting cycles

|Specific Studies

Purpose:

Objective input to help in specific product marketing decisions.

Projects:

Purpose‐built surveys of potential customers, users and distributors.

Uses:

• When problems or opportunities arise from market monitoring...

• New product ideas from innovation phase, R & D or elsewhere

• Changes (mandatory or otherwise) in existing products and services • Any known changes in competitive products and services

• Advertising and promotions (media and creative)

|Promotional Research

Promotional research helps measure the success of a campaign against its objectives. Market research is central to the selection of promotional methods and media.

Promotional research will;

• Determine the best method of promotion

• Enable the testing of campaign material

• Identify suitable media for message

• Help determine the effectiveness of communication strategy

|Product Research

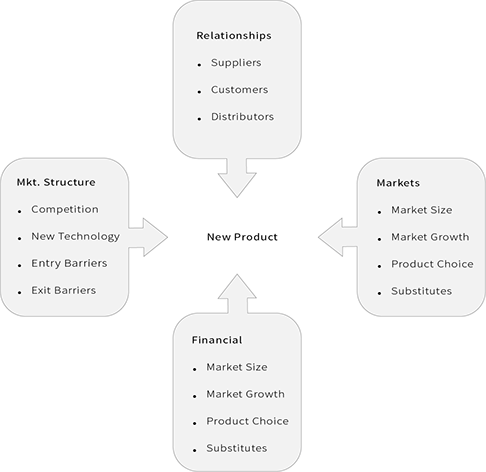

Product research provides managers with the information required to make timely decisions with regard to strategic policies and direction. They can also provide an assessment of your product against the competition.

Product research will;

• Identify and quantify opportunities for new product development

• Ensure product design enables optimum performance

• Measure product performance against the competition

• Determine the look and feel of the product and its packaging

• Assess the contribution of a complementary range of products

• Identify obsolete products

|Market Research and Intelligence Costs

Market research and intelligence can be extremely costly and ‘time hungry’ to achieve. It is most important this is taken into account before embarking on specific project intelligence.

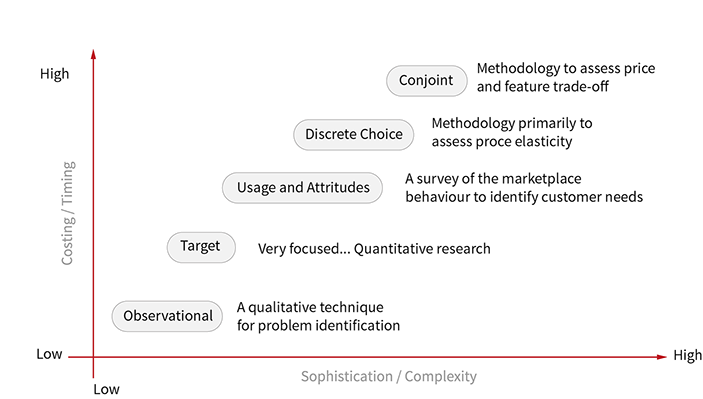

The following represents the cost / time required Vs Sophistication / Complexity of the research process itself.

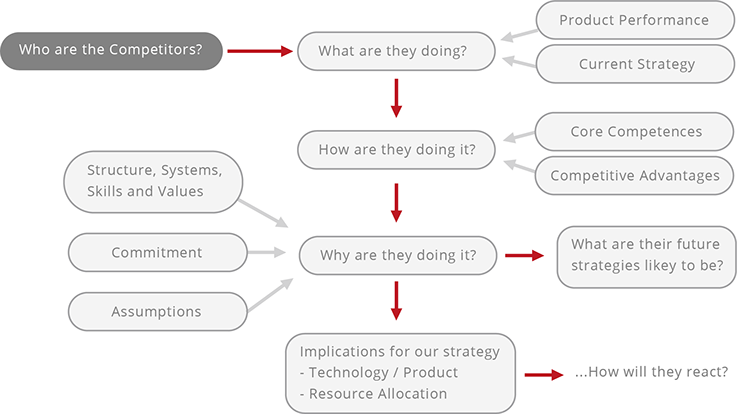

|Competitor Benchmarking

Understanding the ‘Competitor’ is another key success factor in the formulation of your product strategy. Market intelligence once again plays an important part in answering fundamental questions. The following diagram indicates the type of questions that require intelligence data in order for you to develop a competitive strategy.

Please refer to the competitor benchmarking element for further information

|SWOT Analysis

Use the Swot analysis model to evaluate competitor in turn.

Please refer to the SWOT Analysis Element for further information.

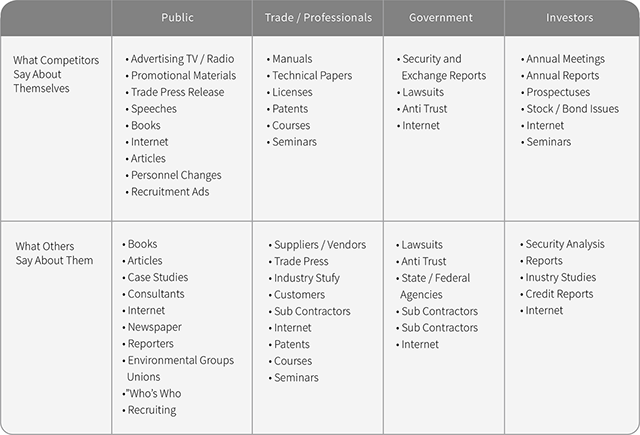

|Source of Competitor Information

|Market Research / Where to Gather Information

The following table is an example of ‘where and how’ to get gather basic market intelligence information. The table itself is not a substitute for a specific research intelligence project and as such should only be used as a way to gather ballpark market intelligence data. You must decide how much time you can allow for this activity. As a guide, 80% of market information can be found within a very short period of time (<2weeks) the remaining 20% will take substantially longer (6 – 12 months).

The table as shown is generic (example only) and will almost certainly require slight modifications to meet your specific product area.

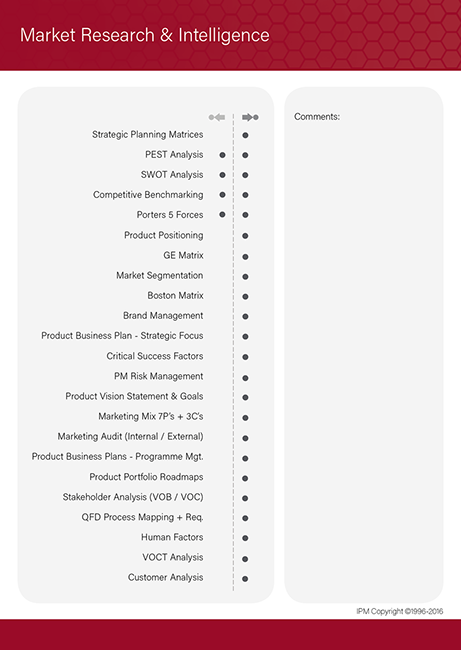

The table is available as a business model entitled ‘Market Research and Intelligence’

|Gemba Visits

The gemba is where the product or service becomes of value to the customer ‐ where the product actually gets used. It is in the ‘gemba’ that we actually see who the customers are, what their problems are, how the product will be used by them, etc.

Gemba means ‘real place’...

... the place where customers are using your products and services.

Unlike other customer information gathering techniques, such as focus groups, we do not ask questions about our problems with technology or marketing, we are not removed to an artificial site such as a meeting room and we are not relying on customers' memories to report problems to us... Rather, we can employ all of our senses to work for us by using contextual inquiry, video taping, audio taping, direct observation, direct interviewing with customer's employees, etc. for the larger purpose of trying to understand how we can help our customers better conduct their business with their customers.

Visits are typically done in pairs, one person to ask the questions and one person to take the notes – Audio record interviews if possible. The purpose of observing customers in the workplace is to give team members an appreciation of what a customers' job is like and how products are used.

Observations can also give you an opportunity to identify constraints or needs that may never arise in a normal conversation.

Once interview guidelines have been created, think about what specific aspects of the customers' environment you want to observe.

|Market Developments and Trends

Knowledge of the current end user price and predictions of future prices are obviously critical to the plan. It is important to derive this information for all the significant distribution channels and for the main variants of the product.

|Products, Services, Technologies and Innovations

With reference to the target market, describe the current and future (primary) technologies and how they impact and enable Products and Services.

Over the following time frames describe what you are expecting to see in the way of applied technologies and innovation. What new products and services are needs to be accomplished in an achievable timeframe. It is helpful to split the analysis into 3 main parts, as shown below.

1) Short Term viewpoint (up to 12months)

2) Medium Term viewpoint ( 1 – 2 Years)

3) Long Term viewpoint (2 – 5 Years)

What are the Driven Innovations in the target market?

What are the Driving Innovations in the target market?

What are the Product / Service Trends in the target market?

|Sales Forecast Model

The planning process requires core market information / data to be accessible in various forms (Volume or Value or both)...

The above model enables us with some degree of confidence to arrive at a ‘realistic and achievable’ sales forecast. It enables us to apply solid business logic whilst moving from the ‘Total Available’ market size through to the ‘Sales Forecast’.

As indicated above the starting point is the ‘Total Available’ market which must be ‘calibrated’ for business planning purposes. Product Managers should contact Management Information (MI) for this information.

If the product / service is already serving a ‘Target’ market, then actual history information should already be available (as above please contact MI). With actual data we will be able to accurately calibrate the model itself. Subsequent strategies together with achievable sales forecasts can then be compiled with a high degree of confidence.

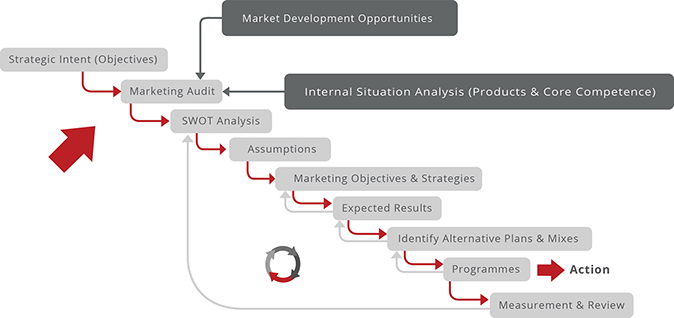

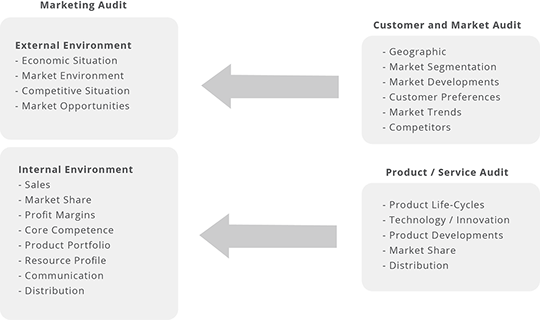

|Market Audit

The market audit is a situational analysis of both internal and external environments. Within the scope of the business planning environment the internal audit will be covered throughout the business planning process. The report will cover the ‘key target markets’ as defined by the company strategic plan.

The purpose of the marketing audit is to provide an unbiased view on the ‘current’ internal capabilities (core competences) and the external opportunities (market size, growth, economic situation etc.).

In the short term Product Managers need only consider a ‘Marketing Audit’ from an external point of view. The timeframe or viewpoint for the marketing audit is short medium and long term. This translates into; next 12months, 1 – 2years, 2 – 5 years.

The ‘marketing audit’ data will be consolidated in a profiles database which will be held by Marketing.

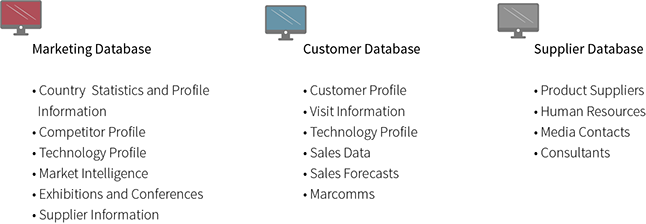

|Management Information - Profile Database

The market profile database is owned and controlled by Marketing. Periodically the profile database will require inputs from Product Managers to ensure that any new market information is added and compiled in a standard format.

Quality ‘up to date’ market / product databases are of paramount importance to the Product Manager. Without access to accurate and timely market information it is impossible for the Product Manager to make the right decision, strategic or otherwise.

- Market knowledge is a key success factor

- Market information does not remain fresh for ever

- A well managed database will put you in control

The benefit of the profile database will become immediately apparent when compiling and reviewing the product business plan. This in turn will translate into consistent market intelligence information with complete integrity.

The following information / statements will be available in the (Management Information) profile database.

Market Data (for the next 5years): Market size, Market Value, Trends, Market Growth.

Economic conditions: Statement of the general economic climate and how it affects your business.

Social & political: special requirements; explicit or hidden trade barriers, country of origin requirements, social / political content.

Regulatory and standards: mandatory specifications and standards of the market.

Technology trends: Technology Road-maps, technologies (pushed by competitors or a general pull)

which this product needs to use or with which there must be an interface.

|Product Managers Database

As stated above the Product Manager should have immediate access to a wide range of data regarding their particular product and associated markets. The collection of core data will be the responsibility of Management Information and Marketing with product specific areas being covered by the Product Manager themselves. It is recommended that a suitable database is used to collate such information in a common format / structure.

For example;

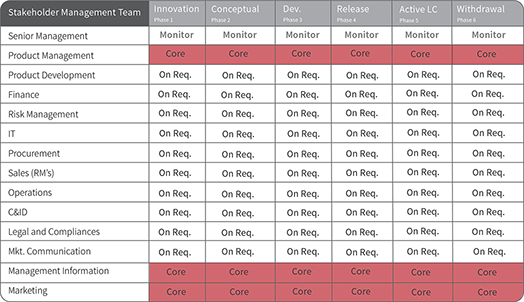

|Who Should Attend

The following delegates / members of the Stakeholder Management Team (SMT) should attend the Market Research and Intelligence requirements workshop... As can be seen a significant proportion of team membership in this element is on a ‘On req.’ basis, this is because of the many combinations and requirements of Research and intelligence programmes required, most of which only impact or concern the Product Manager themselves.

Workshop Tasks Algorithm (Generic) ...

Key / Definition:

Monitor: Oversees the overall process, required to provide top level strategic objectives as required,

performs a management role.

Core: Defines the ‘Core’ team headed (chaired) by the Product Manager required to attend the workshop in alignment with the ‘Product Phase’. Membership is mandatory.

Sec. Mem: Secondary Membership defines an ‘on‐standby’ membership requirement and will depend upon the subject area, phase alignment and the project status. Membership is managed by the Product Manager.

On Req: On Request membership defines a membership that is managed by the Product Manager.

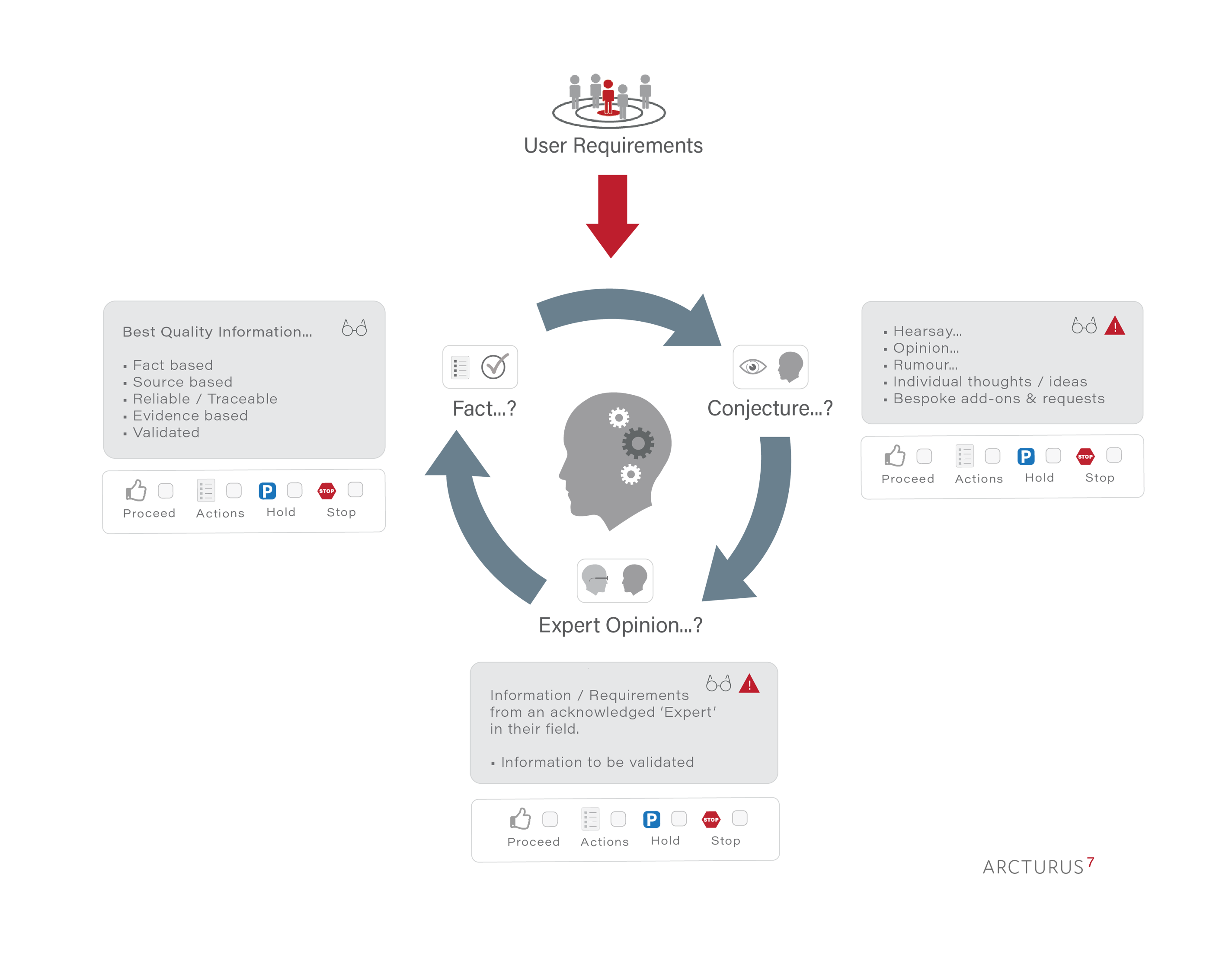

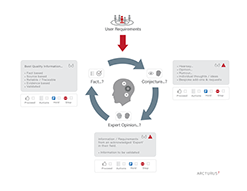

|Information Intelligence - Quality of Information / Validation Algorithm

The quality of Market Research and Intelligence information used within a business planning process is paramount - If you act upon information which is essentially just hearsay (conjecture) the risk you are embedding within the planning process is large and could spell disaster downstream.

The following graphic indicates a check algorithm which is useful for confirming the validity and robustness of information:

|Related Procedures

The following interrelationship maps indicate; suggested content from other models/processes which may have influence or an effect on the analysis of the title process. The left-hand column indicates information or impact from the named process and the left-hand column indicates on completion of the process/analysis it may have an influence or effect on the listed processes.

Note: A complete set (professional quality) of PMM interrelationship cards are available to purchase - please contact us for further details.

|Do's and Don'ts

The following are hints and tips for this element;

- Always use the Profile Database for core data / market information.

- Never make statements which cannot easily be substantiated.

- Never confuse opinion with Fact.

- Justify your assertions clearly.

- Do not exaggerate.

- Avoid manipulating the statistics (you will always get found out).

- Get all your facts right.

- Be pragmatic and accurate.

|Market Research & Intelligence Web links

|Strategic Business Models, Workshop Tools & Professional Resources

The IPM practitioner series, is a definitive and integrated training programme for management professionals operating in the Product Management arena. So whether you’re the Managing Director, Product Director, Product Manager or a member of the Multidisciplinary Team we are confident that you will find this particular training series to be one of the best available and an invaluable asset to both you and your company.

PMM - Professional Support

Workshop Material

Market Research Tools

Market Research ~ FieldPads